Company details for:

KSA Group

Quick Links:

Products / Services

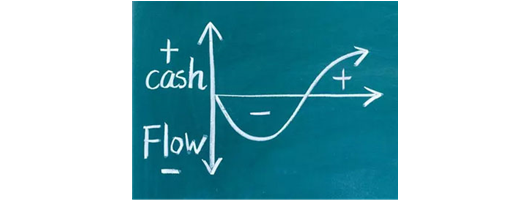

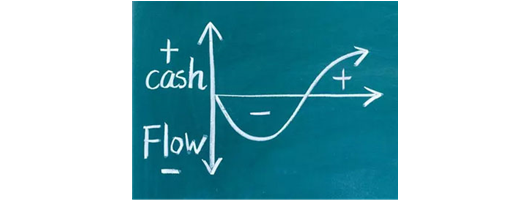

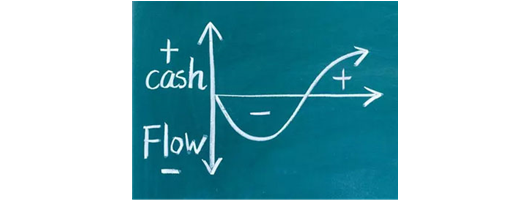

Cash Flow Problems & How to Solve Them

Creditors Voluntary Liquidation?

Creditors Voluntary Liquidation

Compulsory Liquidation

Members Voluntary Liquidation (cash is returned to the members as the company is solvent )

Help for Companies and Businesses Affected by Coronavirus (COVID-19) and Lockdown

Worried Director What Will Happen To Me After Liquidation?

Will the bank call in my loans?

Poor cashflow?

What a personal guarantee means for you

What will HMRC do?

How will Corona Virus affect us? ( see our page here )

Employment compliance and pensions

Marketing and product/ service delivery

Producing meaningful management accounts on time

Keeping up to date with tax reporting and legislation change and filing annual accounts or tax returns

Dealing with banks investors, online lenders, raising working capital

Leasing or renting property

How to pay HMRC

How to win new work

How to pay wages on pay day

Wrongful trading or being made personally liable for company debts

Suffering from stress or losing your property because of a badly performing business

Your Options

You can get lots of help right here! We are here to help you take back control of your business and ensure that you put worry behind you.

How to Close Down a Limited Company

Final corporation tax and VAT payments

Final accounting fees

Bank loans and overdrafts

Any money owed to shareholders or directors

Any remaining accounts owed to trade suppliers

Any outstanding payments of PAYE and National Insurance on the payroll

Any ongoing commitments, including hire purchase or lease agreements

Guides & Knowledge

When you call our freephone number 0800 9700539 you will quickly speak to someone who wants to help you, not criticise you. We help people like you every day - imagine how you will feel when we start to lift the load off your shoulders?

Funding for Companies in CVA

Stop a Winding Up Petition

Why might you have been served a winding-up petition and what happens now?

A winding up petition is a legal notice put forward to the court by a creditor. The creditor petitions to the court if they are owed more than £10,000 and it has not been paid for more than 21 days. The application, in effect, asks the court to liquidate the company as they believe the company is insolvent. Proceeds of the liquidation can be used to pay back creditors. HMRC issue about 60% of all the winding up petitions.

Liquidate a Limited Company

Once you have put your company into liquidation it is a chance to start again.

Remember that a failure of a limited company does not mean that you are a failure.

As long as you have not done anything fraudulent or have wilfully neglected or made the creditors situation worse you do not have much to worry about.

In a liquidation your staff (and this could include you) will be paid redundancy by the government.

London Insolvency Practitioners

I Can't Pay My VAT Bill

About us

Here at KSA Group, we specialise in delivering exceptional insolvency solutions to businesses and organisations across the UK and beyond.

Based primarily in London, our company helps businesses both large and small achieve their maximum potential by helping them solve any problems they may be facing. We give outstanding advice to directors, creditors and stakeholders in any insolvency situation, allowing for better business management as a whole.

We as a company specialise in cash flow problems and how to solve them, the warning signs of a struggling company, the meaning of liquidation, help for businesses affected by Covid-19, guidance for worried directors, hospitality rescue, assessing numerous situations, how to close down a limited company and so much more.

We have enough knowledge and experience within the insolvency industry to provide excellent service to clients from beginning to end.

Images

Articles / Press Releases

Brochures

Reviews

Trade Associations